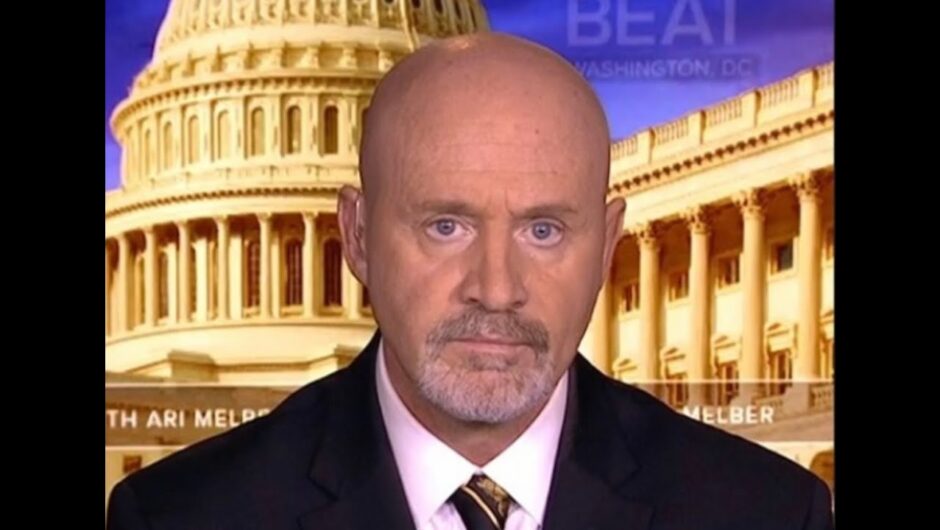

Detective acting Superintendent Ben Case.

They also pretend to be the chief executive and issue instructions via compromised email accounts.

In the past six months alone, there have been 1146 reports of BEC and more than $30 million has been stolen.

Acting Superintendent Case urged people to double check before transferring money over the Christmas holiday period.

Cybercrime has become a huge problem in Australia with a cybercrime reported every 10 minutes, he said.

“Cybercrime is one of the most pervasive threats facing Australia, and the most significant threat in terms of overall volume and impact to individuals and businesses,” the annual report of the federal government’s Australian Cyber Security Centre says.

Australians lost almost $634 million to cyber scams in 2019 but the annual cost of cybercrime, including security incidents, is estimated to cost Australian businesses as much as $29 billion annually.

A prominent Sydney crime group’s failure to check its own fraudulent transfer details led to numerous convictions following Australia’s most audacious bank heist.

On Christmas Eve 2003, police were conducting surveillance on the Lady Jane’s strip club in Sydney’s CBD, the criminal headquarters of underworld boss “Teflon” Tony Vincent.

They were surprised to see some top-notch crime figures rushing to attend a late-night meeting. Phone chatter intercepted by police revealed there had been some trouble with “transfers”. Police thought they were referring to a drug importation.

One of those arriving that night was “Mr Pink”, the code-name used by Dallas Fitzgerald, the son of notorious bikie boss Felix Lyle. Earlier that day, Vincent and Fitzgerald had orchestrated the nation’s most audacious bank heist.

The pair had used a Telstra technician to hot-wire a specific phone line into JPMorgan bank, where they authorised the transfer of $150 million into bank accounts in Switzerland and Greece, and two in Hong Kong.

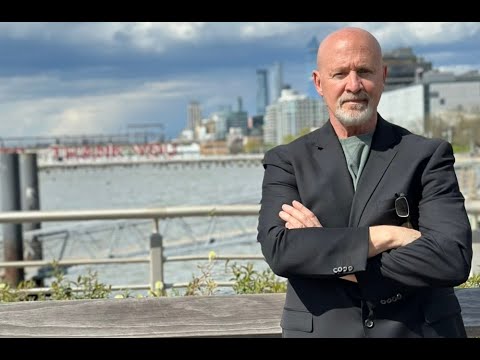

Organised crime boss Tony Vincent.

Police were listening as the Greek account holder rang Vincent at his strip joint to tell him there had been a slip-up in the transfer instructions with the crime group erroneously adding a “Ltd” to his personal account details.

He told Vincent that the bank manager at the Laiki Bank in Athens had personally rung him to ask him if he was expecting $71.9 million in his account. The bank manager said the multimillion-dollar transfer would have to be resent by the bank.

Three days after Christmas, JPMorgan staff returned to read the fax from Athens about the suspicious transfer.

Horrified, they moved to freeze the other accounts. Millions had already disappeared from the Hong Kong account but the crime group’s attempts to transfer the money into other untraceable accounts had failed.

After almost two years of painstaking investigations, federal agents Brad Kirwan and Scott Miller made their arrests in August 2005.

Fitzgerald and Vincent, who was already in jail for drug offences, both received three-year sentences.

“It’s the best job, I’ve ever worked on,” said Miller, who has since worked on Project Wickenby targeting white-collar tax frauds.

Kirwan said that one thing that hadn’t changed with organised crime was that “if they can make money, they will come together to facilitate the crime”, whether it be drug trafficking, money laundering or cybercrime.

Kate McClymont is an investigative journalist at The Sydney Morning Herald.

Most Viewed in National

Loading