On Tuesday, Telstra confirmed an earlier Herald report that it would pass its AFL and NRL sport content to Foxtel, meaning the AFL and NRL will each have only two broadcast partners – Foxtel and their respective free-to-air networks – rather than three. Last year, the NRL renewed its Foxtel deal until 2027.

Kayo will now replace the AFL and NRL Telstra live passes, previously offered free to existing Telstra mobile and internet customers. Fans will now pay $5 a month to stream live matches via the NRL App, while Telstra customers who do not have a live pass will be expected to pay $15 a month. The offer lasts only for a year and is expected to be reviewed annually.

Finals in both codes have been added to the packages.

However, netball will be free, for two games a week of their league, plus domestic Diamonds games, with immediate access by entering an email address into the Kayo Freebies streaming service.

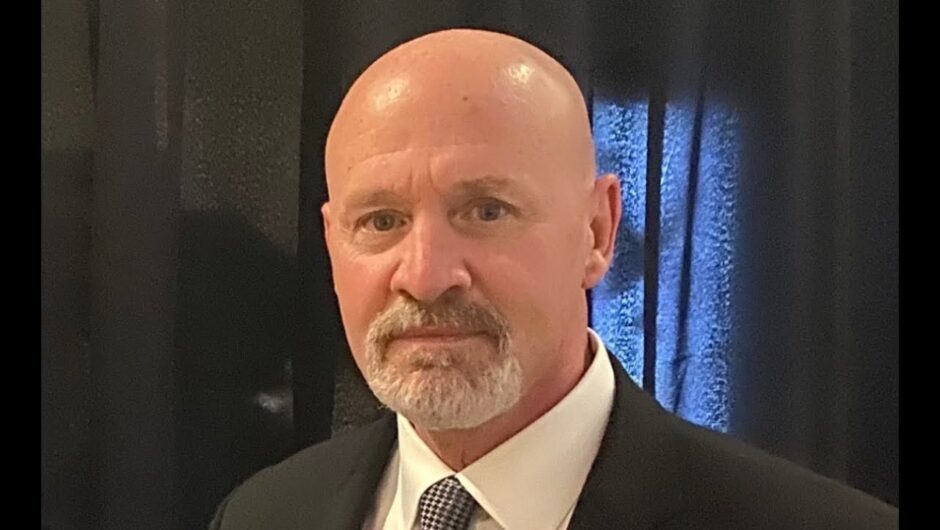

Telstra will pass its AFL and NRL sport content to Foxtel.Credit:Getty

The NRL’s free-to-air deal with Channel Nine expires at the end of 2022 and these rights could eventually be obtained by Kayo Freebies, satisfying the federal government’s anti-siphoning legislation, which insists top sport be available to the public free of charge.

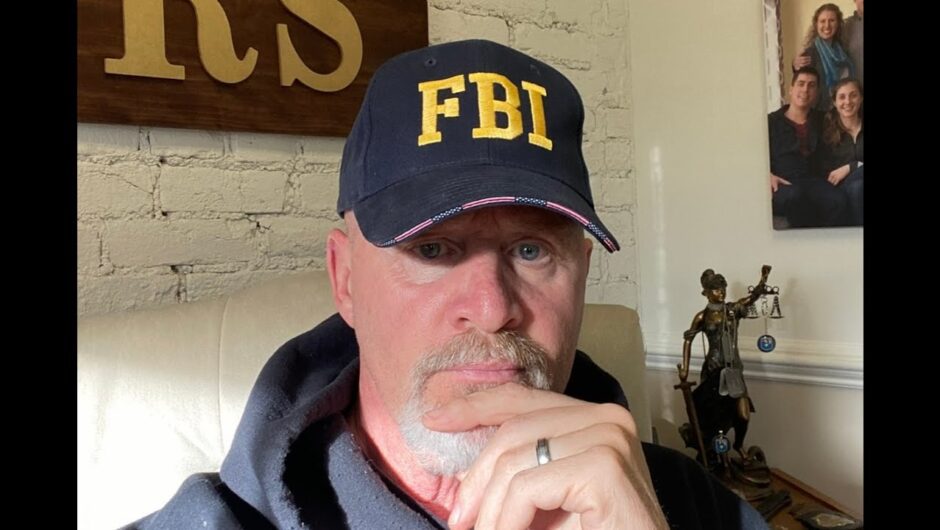

Foxtel chief Patrick Delany gave the clearest signal yet that this is his end game, saying: “The Kayo Freebies is very much about keeping subscribers engaged when they pause their subscription and it means that if we can’t find a free-to-air partner or the deal is not appropriate, we have got the Freebies. There will be more announcements about that. It means that we can really aggressively move forward with growth.”

Sports media executives believe there will now be a competitive environment for Australian sports media rights on free-to-air TV and pay TV. Yet, Kayo appears intent on knocking all competitors out of the mainstream sport ring, particularly the Nine-owned streaming service Stan Sport, which has acquired what some would say is second-tier sport: the rights to Australian rugby union and the Australian and French Open tennis tournaments.

Telstra’s deal with the NRL and AFL did not officially expire until 2022, meaning Tuesday’s announcement of passing on its content to Kayo will raise questions about why it didn’t offer Nine’s Stan an opportunity to participate in bidding.

The answer is in the shareholding of the Foxtel-owned Kayo: Telstra owns 35 per cent and News Corp 65 per cent of Foxtel. Not only will the media company and the telco share in the growth of Kayo, but they will no longer be competitors for sports content. It’s a smart move by Telstra that will enhance the value of an asset that it part owns.

Nevertheless, the big sports are not likely to be losers from what appears to be a diminution of competition, provided Kayo grows to the extent expected, with numbers expected to eclipse the one-third of Australians currently connected to Foxtel.

More subscriptions should translate to higher rights fees – provided there is competitive tension with rival broadcasters.

The challenge for Kayo is to encourage customers to stay with the service to the extent viewers remain with pay TV and free-to-air TV, given the attention span of Generation Z on mobile phones. The average time fans watch NRL or AFL content on Kayo is only 10 minutes, compared to 55 minutes on linear TV.

Loading

So, while growth in Kayo subscriptions is expected to be stratospheric, it may not translate to viewer hours and therefore initially advertising revenue.

While Nine has just under two years to secure a free-to-air NRL deal, sports chiefs are witnessing a period of unprecedented change. Even if Nine’s three NRL games a week end up on Kayo Freebies, ARL Commission chief Peter V’landys will want his jewels, State of Origin and the NRL grand

final, on a mainstream free-to-air network.

Roy Masters is a Sports Columnist for The Sydney Morning Herald.

Most Viewed in Sport

Loading