“I don’t class myself as a fool but they say a fool is easily parted with his money and that’s what happened to me,” he said.

“It only takes a press of a button and once you get talking to somebody that’s a scammer, they just take it over, they are that good, it’s really scary.”

The Samson local said the scammer called him before starting an email correspondence, at first asking for small amounts of money to invest that got larger and larger.

“I was confident he knew what he was talking about so I didn’t expect a scammer to be that good,” he said.

“[Being the victim of a scam] is not going to kill me and I’ll get over it, and I have, but you lose a lot of self esteem when something like that happens and your kids look at you in a different way and say, ‘Dad, before you do another investment, give us a yell will ya’ and that sort of thing, so it’s a bit hard to take.”

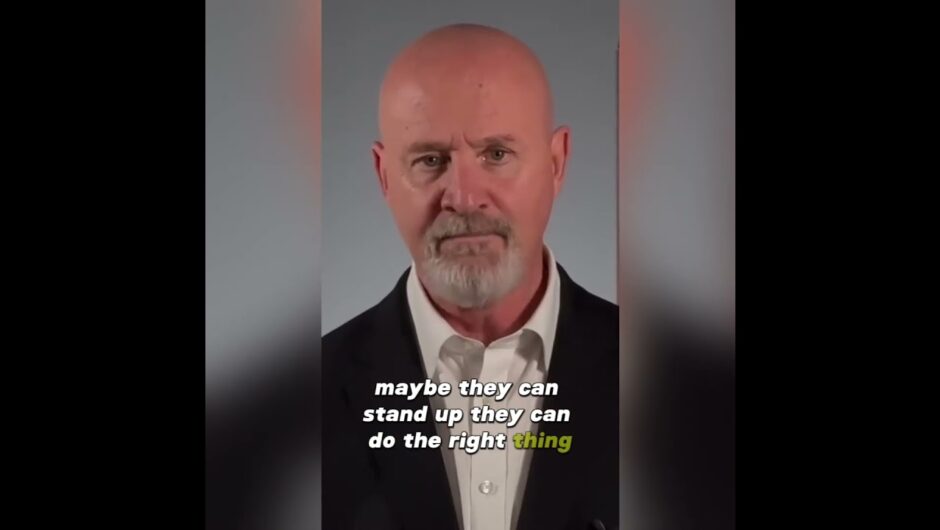

WA scam victim, Terry.

Terry said he realised he had been conned when the scammer refused to let him cash out one-fifth of what he thought was $100,000 in earnings.

Consumer Protection commissioner Lanie Chopping said WA ScamNet worked to remove fake websites, classified listings and social media pages once alerted to suspicious activity.

“Looking at demographics across all categories, it is interesting to note that the largest losses have occurred in the 25-34 age group while the highest number of reports have come from the 65 and over group,” she said.

“Posting fake ads, creating fake websites and sometimes threatening their victims by phone are just some of the many tactics used to steal money from people.

“For example, recently about 30 puppy scam sites were deleted by a domain host company after being approached by our consumer fraud liaison officers.”

The number of scam victims in WA in 2020 increased to 952 from 705 the previous year, however the amount of money swindled dropped from $13.6m to $11.8m.

Investment ($5.38 million) and romance ($2.17 million) scams topped the list of categories.

More than $1 million was lost to calls from scammers pretending to be government agencies, such as the ATO.

Ms Chopping said payment redirection or ‘man in the middle’ scams continued to be of major concern, with 39 people reporting total losses of about $750,000 in 2020.

“This scam involves the hacking of email accounts and the cloning of addresses, so when there are financial transactions such as payment of an invoice or purchase of a property, the scammer impersonates one of the parties by sending a fake email that requests funds be sent to the scammer’s bank account instead,” she said.

“A simple solution to this scam is to verify by phone any email request for money, especially if a change of bank account is involved.”

Heather McNeill is a senior journalist at WAtoday.

Most Viewed in National

Loading