“We’re inherently better off in many ways to sustain a competitive market than our competitors,” he said. “We’re a very low-cost operation so we can sit there, knowing we can sustain it longer than either Qantas and Virgin, so in the end it will hurt them more than it will hurt us.”

Rex decided to branch out from its regional heartland after Virgin went into administration in April last year and shutdown its budget arm Tigerair. The carrier has secured cheap leases on six Boeing 737s previously flown by Virgin, employed pilots and cabin crew laid off by the major airlines due to COVID-19, and says it has a rare opportunity to secure landing slots at Sydney Airport while COVID-19 keeps other planes grounded.

Loading

Qantas boss Alan Joyce predicted in January that Australia can still only support two domestic airline groups and that either Rex or Virgin will eventually fold.

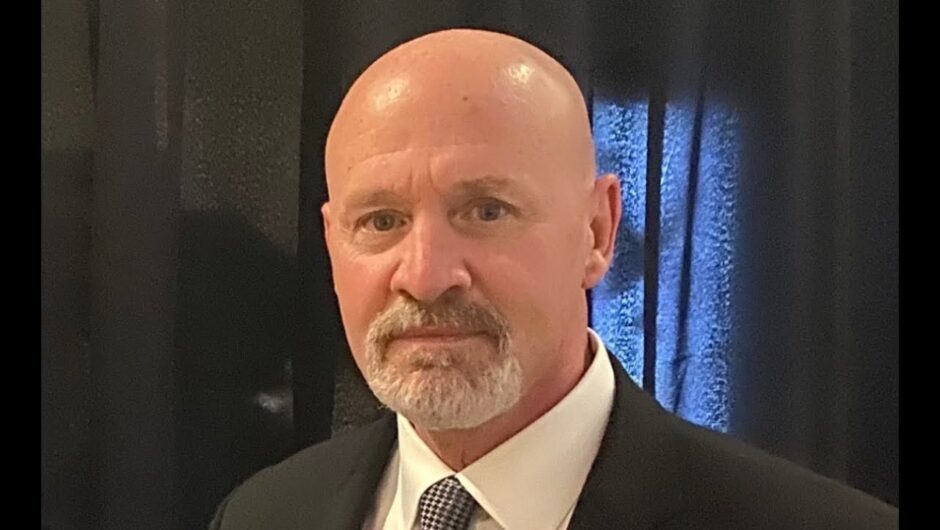

Melbourne Airport chief executive Lyell Strambi said on Monday that while Australia had been an airline duopoly for many years, the market had “doubled or trebled” over that time period.

“There is room for a third player but there’s no underestimating that it’s a very tough market to break into,” Mr Strambi said. “Rex is an existing carrier, they’re well supported they’ve got a fan base of customers and they should be successful. No doubt it’s going to be hotly contested but if anybody can succeed it’ll be Rex.”

Mr Strambi added that Rex’s entry “adds a little spice” to the market and hoped that would lead to lower airfares, especially given Rex was offering both economy and business class tickets.

Australia’s aviation market is still operating at only 50 per cent of its pre-COVID capacity but the rollout of vaccines has buoyed hopes of a recovery through 2021. Qantas last week forecast that it would return 80 per cent of its capacity to the sky in the June quarter, but the recovery hinges on state borders remaining open.

Rex on Friday afternoon reported a $9.9 million statutory profit for the six months to December 31 – compared to a $1.03 billion loss at Qantas – thanks to $65 million it received in government grants and subsidies designed to maintain air connectivity to regional Australia, and JobKeeper payments. Excluding those payments Rex fell to an underlying loss of $900,000. It’s shares closed the session on Monday 6.6 per cent stronger at $1.69.

Business Briefing

Start the day with major stories, exclusive coverage and expert opinion from our leading business journalists delivered to your inbox. Sign up for the Herald‘s here and The Age‘s here.