But make no mistake: I appreciate the value side of the equation, too.

When I’ve downgraded my level of insurance cover, to reduce my premiums, I’ve fully appreciated that I am getting a lesser insurance product.

What matters, ultimately, is that I get an insurance product that meets my preferences. One that suits my risk appetite and ability to self-insure in a crisis and hence provides real value to me. And that value, my friends, is entirely in the eye of the beholder.

In my enthusiasm for a “deal”, I have been, in fact, acting entirely in accordance with one of the most fundamental concepts in economics – that of “consumer surplus”.

Let me explain.

According to economics, happiness is created via transactions which maximise both the “producer surplus” and the “consumer surplus”.

When a company can sell a product for more than it would be willing to sell it, a “producer surplus” is created. Happy producer!

On the other side of the transaction, when a consumer buys a product for less than what they would have been willing to pay for it, a “consumer surplus” is created. Happy shopper!

Add them together and you get a total “community surplus” of happiness, satisfaction, utility – whatever you want to call it. Some economists call it “total welfare”: That is, the total welfare of society is maximised, shared in some proportional split between producer and consumer. It’s a win-win. We are all better off.

On this reckoning, society’s total happiness is literally resting on your ability, as a consumer, to know your willingness to pay for certain goods and services. What do you truly value? How much would you really be willing to pay for something?

If you manage to pay less than your maximum, bravo – you’re winning! If you’re spending more than your maximum for something, it’s time to think again.

Sometimes, of course, you get little choice in the matter. But when you really look at it, shop around and get to know your values, you can find so many ways to maximise your “consumer surplus”!

What really matters is actually knowing your innate individual preferences. Not those of society. Or your mum. Or the salesperson selling you the product.

Knowing the real value of something to you takes work. It takes introspection. Often, it’s a process of trial and error of buying things you don’t value to figure out what you really do value.

That expensive car you bought, that pair of shoes you never wore – they’re all pieces of information.

Economists always advise to ignore “sunk costs”. That is, don’t let the money you’ve spent on something influence your next decision. But don’t forget about “sunk costs” altogether. That money you wasted is the most powerful pointer to what your true values are.

Loading

Turns out, education is one of my highest values. Understanding the world around me is one of my life’s greatest passions – and one for which I am, very gratefully, well remunerated.

So, in my household budget, I give “education” a budget of its own. My category is heavy on private school fees, uniforms, books and stationery. Click here for my

Economists describe education as “human capital formation”. And, in the long run, it’s the main road to riches – for both individuals and society at large.

As a society, we collectively get richer when we get smarter and figure out better ways of doing things. Essentially, we figure out ways to produce goods and services in a more efficient way that produces greater output from a given set of inputs.

It’s the magic ingredient of capitalism. Fundamentally, it’s the reason why shares gain in value over time – the ability of business people to combine physical capital and labour to better effect, yielding greater value.

So, as you search for savings to maximise your “consumer surplus”, make sure you’re putting a little aside to invest in your continuing education. That way, you can continue to learn both the price and value of everything.

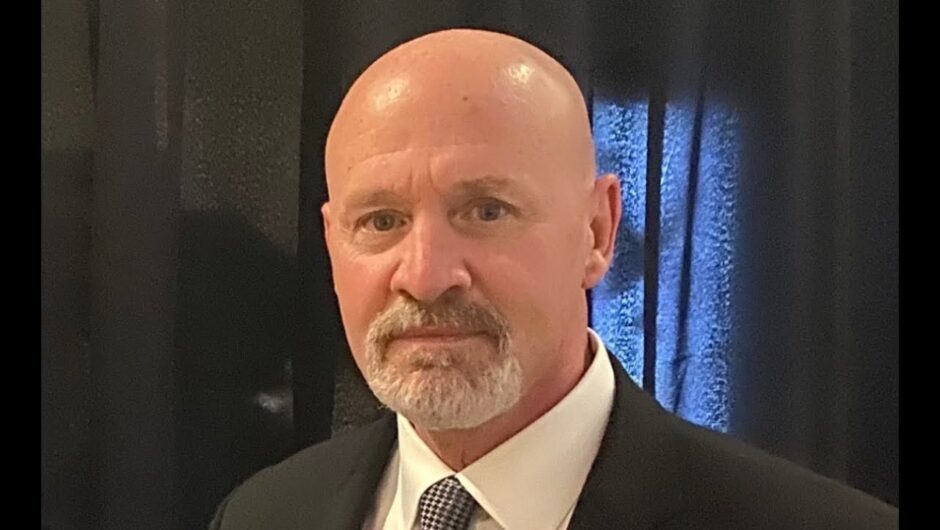

You can follow Jess’ money adventures on Instagram at @moneywithjess or subscribe to her email newsletter via the Age at newsletters.theage.com.au/moneywithjess or via the Sun-Herald at newsletters.smh.com.au/moneywithjess

Jessica Irvine is a senior economics writer with The Sydney Morning Herald.

Most Viewed in Money

Loading