In the meantime, let’s recap on 2020 and what a year it has been. Our first recession in Australia in nearly three decades. An incredibly tough year for so many, particularly those whose jobs have been affected by COVID-19-related shutdowns.

For many families, belts have forcibly tightened. For others, there has never been a better time to get to grips with your finances – even if it’s only to reassure yourself that it is safe to spend again. Our economy depends on it.

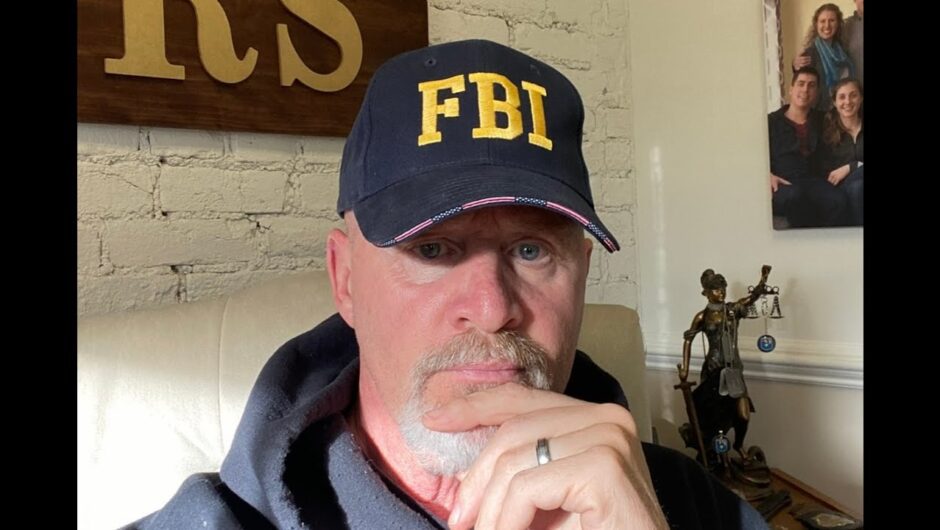

If looking to keep grocery costs down, Aldi is the place to start.Credit:

For me, it’s been a full year of home ownership and learning how to manage my monster mortgage.

I’ve made several tweaks to my household budget – most notably, actually having one – to get ahead in these tough times.

So, as my early Christmas present to you, here are the 20 top ways I found to save some extra cash.

1. Shop at Aldi. When I did the sums, comparing the same basket of goods at Aldi versus Coles, the winner was clear. Aldi was 11 per cent cheaper overall. Of course, they don’t stock everything and you must avoid the random middle-aisle of specials, but if you’re looking to save cash, Aldi is a great place to start.

2. Don’t buy cherry tomatoes. Those delicious little bundles of sweetness can cost up to $20 per kilogram or more, compared to $3 or $4 per kilo for ordinary tomatoes. The lesson is: check per unit pricing on price labels to make sure you are paying the lowest price per kilo or per unit.

3. Increase your insurance excesses. If you ever need to claim on your private health, car or home insurance, you’ll be out of pocket by the increased excess amount, of course. But if you take the risk, you can save hundreds a year in reduced premiums, which you can put towards any future claim.

4. Prepay your health insurance to beat annual price hikes. Every April 1 (although, due to the coronavirus it was October 1 this year) premiums get hiked. If you can afford it, prepay your annual premium the day before new prices kick in.

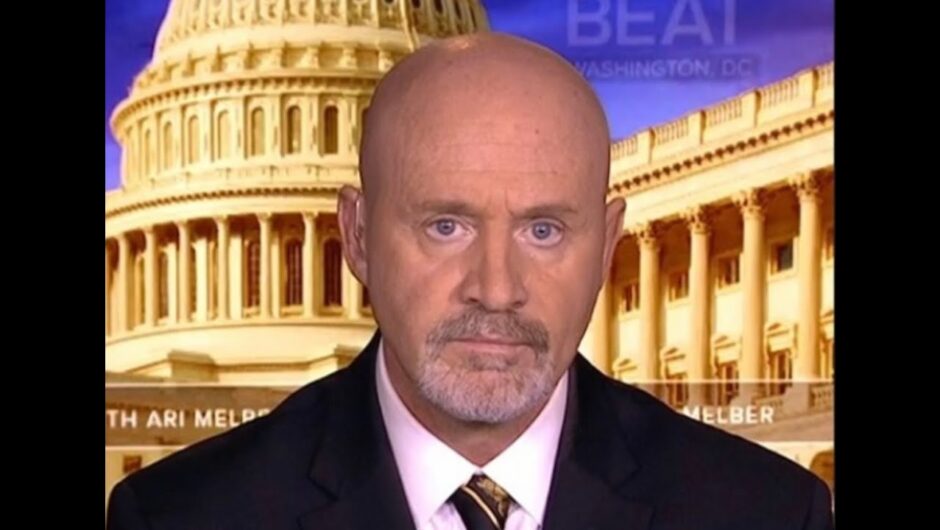

5. Ask insurers to quote you on a new policy. This is a tip from former competition tsar, Allan Fels, who found insurers charge a significant “loyalty tax” to existing customers. Often, premiums increase automatically each year – beyond the prices for new customers. Check what your insurer is charging new customers and if they won’t give it to you, walk away.

6. Shop around for tyres. It may not be glamorous but shopping around on tyres can save you hundreds of dollars. Search online to bag a saving.

7. Don’t use Premium 98 petrol if you don’t have to. Check your car manufacturer’s specification, which can usually be found inside your petrol flap.

12. Establish your own “Future Funds”. Otherwise known as “sinking funds”. First, identify an expense that hits annually and then set aside a regular amount each month so you don’t get bill shock when it lobs.

13. Check your mortgage interest rate. It should have a “2” in front; and a low “2”, at that.

14. Cut your own hair. Warning: this is very stressful. Results can vary.

15. Don’t cut your hair. Should point 14 prove too stressful, just grow your hair long, like me.

16. Don’t buy clothes. I didn’t, for most of the year. Until I bought a $14.99 pair of jeans from Aldi. Because they were $14.99!

17. Buy furniture second hand on Gumtree or Facebook marketplace.

18. Sell your clutter online. I’ve made nearly $3000 selling stuff on Facebook marketplace this year.

19. Use up your health insurance benefits. It’s not too late to book a dental or optometrist appointment and make sure you use up all your annual limits, most of which reset on January 1.

20. Subscribe to the Money with Jess newsletter. Shameless plug. But I’m on a mission to unearth new savings in 2021 and you don’t want to miss out!

Until then, have a peaceful break and I’ll see you next year.

Jess xx

You can follow Jess’ money adventures on Instagram at @jess_irvine_pics. Her regular Money column will re-appear in the first edition for 2021 on January 17.

Jessica Irvine is a senior economics writer with The Sydney Morning Herald.

Most Viewed in Money

Loading