Even with the improvement, they are the largest budget deficits in nominal terms on record. Treasury is expecting a $45.7 billion deficit in 2030-31 with gross debt beyond $1 trillion.

The government has committed itself to not actively trying to repair the budget until unemployment is “comfortably” below 6 per cent. Spending as a share of GDP, this year expected to reach a post-World War II high of 33.4 per cent, is forecast to be at 26.9 per cent in 2023-24.

The budget update shows the jobless rate is tipped to fall below 6 per cent in 2023.

But Mr Frydenberg said he believed “comfortably” below 6 per cent was between 5.25 per cent and 5.5 per cent, a level that is not forecast to be achieved until mid-2024.

“These are, of course, forecasts and next year some of our income supports are tapering down and there’s other economic support coming into the economy and we’re all hopeful about a vaccine,” he said.

Loading

“A lot does depend on a vaccine being successfully rolled out across the world in terms of international borders and the like.“

In October, Mr Frydenberg announced cumulative deficits of $482.5 billion over the forward estimates. Despite the better economic outlook and stronger commodity prices, the cumulative deficits have only been upgraded to $456.6 billion.

Company tax collections are expected to be $2.9 billion better than the October forecast while GST is tipped to be $2.8 billion or 4.4 per cent better this year.

But the biggest increase is in dividends, which are forecast to be 27.8 per cent better this year and 37.5 per cent higher next year. This is due to the $1.3 billion fine paid by Westpac for breaching anti-money laundering laws and higher dividends paid by the Reserve Bank.

Several large expenditures have yet to be fed into the budget, including a possible increase in the JobSeeker base payment and the formal responses to the royal commissions into aged care and abuse and neglect of people with disabilities.

The economy is expected to grow by 0.75 per cent this financial year, after being forecast to contract by 1.5 per cent at budget time. However, growth is tipped to be 3.5 per cent in 2021-22 rather than the forecast 4.75 per cent.

Growth also relies heavily on government spending, with public final demand forecasts upgraded this year and next.

There was positive news on the economy on Thursday, with the Australian Bureau of Statistics reporting the unemployment rate in November dropped 0.2 percentage points to 6.8 per cent.

About 90,000 people gained work through the month which much of that occurring in Victoria where 155,000 positions have been added since October. Despite the increase, Victoria’s jobless rate is at 7.1 per cent compared to 6.5 per cent in NSW.

Loading

There are now 942,100 people unemployed across the country, 17,300 fewer than in October. There are still 240,700 more people out of work than at the same time last year.

The underemployment rate improved by 1 percentage point to 9.4 per cent and 43 million extra hours were worked over the month. There has been an 86 per cent recovery in the number of hours worked since the peak of the crisis in May.

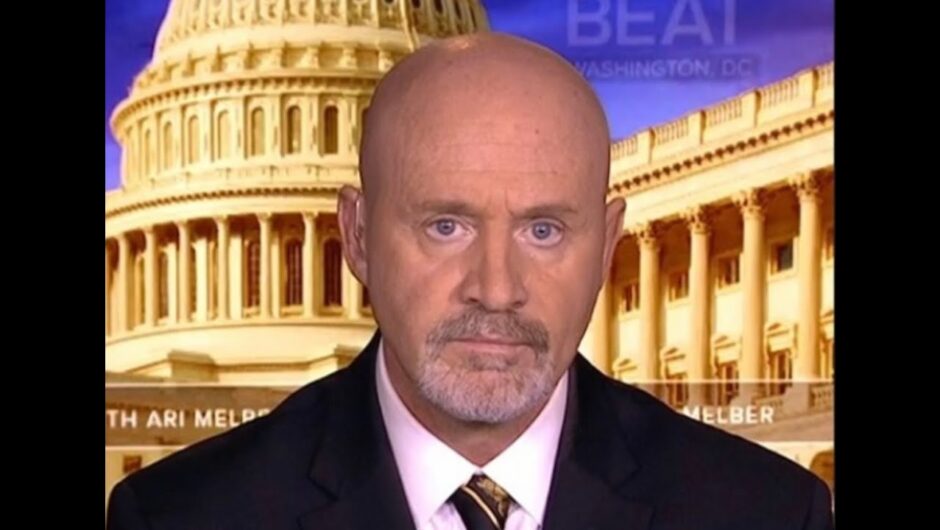

Shadow treasurer Jim Chalmers said all of the debt run-up by the government dealing with the pandemic could only be justified if people were better off.

“This recovery will only be worth the sacrifices that Australians have made over the course of the last year if more Australians can actually participate in that recovery,” he said.

Shadow treasurer JIm Chalmers says the debt run-up by the government could only be justified if people were better off.Credit:Alex Ellinghausen

Ratings agency S&P Global said despite the apparent improvement in the budget numbers, it would take “years for a substantial fiscal recovery”.

“While most stimulus measures are temporary and targeted, taxation revenues and social welfare payments will take years to recover, and debt stocks will remain structurally higher. Further, trade tensions and geopolitical risks are likely to hinder parts of the economy,” he said.

Shane is a senior economics correspondent for The Age and The Sydney Morning Herald.

Jennifer Duke is an economics correspondent for The Sydney Morning Herald and The Age, based at Parliament House in Canberra.

Most Viewed in Politics

Loading