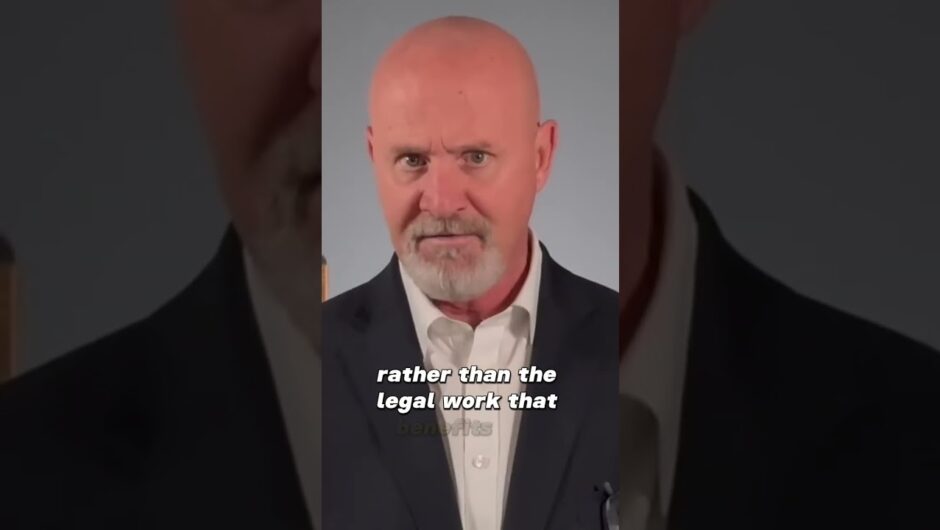

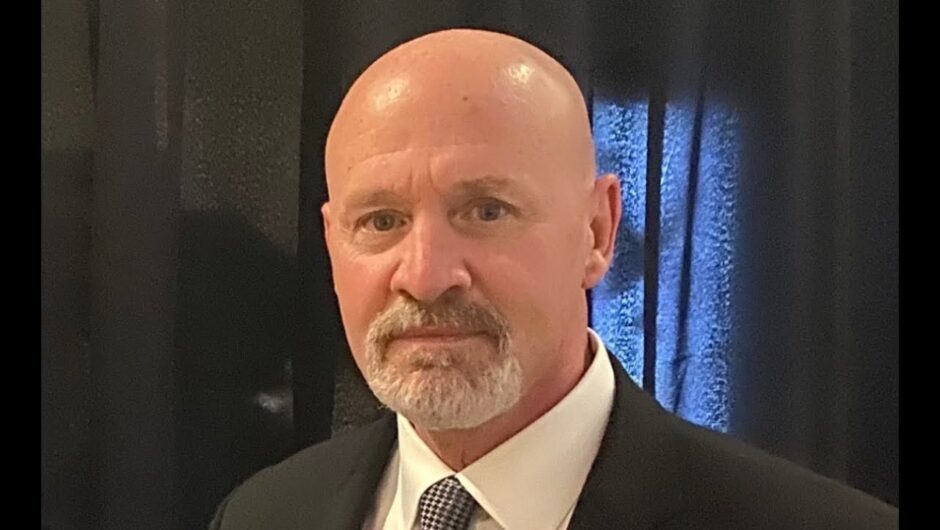

Mondelez, the second-largest snack food company in the world after Pepsico and boasting brands such as Cadbury chocolate, Oreo cookies, Philadelphia cheese, Ritz and Captain’s Table crackers, wants to expand its brands stable into more premium entertaining products by using its global research and development functions and making more acquisitions. “We have spent $400m in our Australian factories over the past five years. Labour is very expensive in this country. You need to make premium products that people want to pay for and ensure that you are manufacturing in a smart way,’’ Darren O’Brien, Mondelez president for Australia, New Zealand and Japan told The Australian in his first media interview since taking the local role last May. He had previously been running Mondelez’s billion-dollar global meals business from Switzerland.“We anticipate we will spend a significant amount of further capital here over the next five years. With our current growth agenda we would be looking to spending another $300m. That is where our planning is,’’ he said. Two years ago Mondelez global chief executive Dirk Van de Put launched a “local first” strategy giving the Australian business more responsibility for profits generation and more input into decisions on capital investment, product development, marketing and promotions. As part of that strategy Mondelez this week agreed to buy Australian cracker business Gourmet Food — whose brands include premium cracker labels OB Finest, Olina’s Bakehouse and Crispbic — for more than $400m. Fifty-five per cent of GFH’s revenue comes from Ocean Blue pre-packaged seafood, the biggest selling brand in smoked salmon.The deal, which is not subject to regulatory approvals after winning pre-clearance from the Australian Competition & Consumer Commission, will give Mondelez its seventh local factory and its first biscuit-making facility. “In GFH alone we will spend $20m just to keep up with the growth agenda,” said Mr O’Brien, “One of the things this business does for us is allow us to take these products to places like Japan, where natural ingredients and Australian-made commands a premium.” Mr O’Brien said Mondelez, which makes about 90 per cent of products locally and employs 5000 Australian staff, was also attracted to GFH because of its “very entrepreneurial, fast approach”. “They can take products from idea to product in 16 weeks. That is something we will look to learn from. We share a value with GFH around being customer- and consumer-focused. Bringing that element of agility and speed is something we can leverage … We want to take Australian-made products outside the country.” Kidder Williams advised Mondelez on the deal.Last year, the federal government chose food and beverages as one of six manufacturing sectors to benefit from $1.5bn in funding in the budget, including accelerated depreciation schedules for big capital investments, from which the government was hoping to stimulate $200bn in business investment in new machinery and equipment. It hopes this and other tax measures will boost the economy by $12.5bn over the next two years and create an extra 50,000 jobs. “The government’s modern manufacturing strategy and the instant asset write-off continues to be attractive to us to make more investments into our local manufacturing base,” Mr O’Brien said. He said Mondelez had enjoyed strong growth over the past year during COVID and had its six manufacturing plants running for the duration of the crisis. No staff were laid off, wages cut or government subsidies sought. “The best thing we had to do was impress to our staff that the crisis was an opportunity. A big part of it was around mindset,’’ he said. “We had very good growth during COVID. Philly cream cheese in particular had standout growth. But the interesting thing is it hasn’t ended. People have returned to trusted brands they love.” Last year Mondelez partnered with a range of businesses across Victoria to establish a power purchase agreement to source renewable energy for two of its factories from the Yaloak South Wind Farm. Mr O’Brien, who also chairs the Australian Food and Grocery Council, said the group’s next key focus was around sustainability in packaging. “We are looking at how quickly we can get to recycle content into our soft plastics packaging,’’ he said.“It is also critical for Australia to get chemical recycling done onshore and kerbside collection in place for soft plastics with the aim of having no virgin content going into packaging.”

Source link

Don't Miss it

National icon pays price of NSW policies of extinction