It’s been quite a journey, I can tell you. One with ups and downs, but a general downward trend – with the notable exception of the COVID-19 lockdown last year.

I can honestly say that today I feel more in control of my diet and exercise than ever before.

What’s that got to do with money? Well, a lot, actually, when you consider the typical Aussie household forks out about $10,000 a year on food.

I’ve managed to wrangle my food bills down to about $350 a month for myself and my son (who lives with me half the week).

If you, too, are looking to minimise your food budget, here are the top seven strategies I use.

1. Examine your relationship with food

Food can mean many things to many people. For some, it’s a way to express love. For others, a way to connect. But for me, it’s just food. It’s calories and nutrients I require on a daily basis to sustain life.

2. Tackle emotional eating

Which is not to say it has always been this way. I’ve come to realise the main culprit for my weight gain has been a tendency towards “emotional eating”, or eating for comfort.

This year, I made a New Year’s commitment to track every calorie I eat in 2021.

It’s been a revelation and has allowed me to analyse the times I’ve been emotional eating. I don’t judge it, or stop it. I just write it all down. When I look back, I can clearly see I am most vulnerable to excessive eating when I’m stressed, tired or pre-menstrual. Observation is the first step. Compassion is the second.

3. Try the ‘GST diet’

Did you know, when you get your grocery receipts, they will tell you for each item you’ve bought whether you paid GST on it? At Aldi, it’s denoted by an “A” or a “B” next to the price. At Coles and Woolworths it’s sometimes a “%” sign.

One savings strategy to shave 10 per cent off your food bill is to buy only non-GST items.

I bought 98 food items this month, of which just 10 attracted GST. They were: cupcakes, lamingtons, frozen lasagna, frozen pizza, fruit bars, quiche lorraine, fruit drink, BBQ-flavoured crackers, kids’ lollies and pretzels. The rest comprised meats, fruit and vegetables – you know, the stuff we know we should be eating. Turns out, the government also rewards you for doing so!

4. Conduct a pantry, fridge and freezer audit

Before you mindlessly head to the shops, have a good look in your cupboards. I bet you have enough there to sustain you for a lot longer than you think. I literally get a white board and list out what I have under the categories of “proteins”, “fats” and “carbs”.

Eliminating food wastage is one of the best ways to guard your dollars.

5. Become a food ‘assembler’

I am no master chef. There are no fancy recipes in my kitchen. Come meal time, I simply grab a protein source, a fat and a carb – preferably some fresh vegetables – and call it a day.

If you love cooking, great. But for the rest of us, it’s perfectly fine to just assemble food.

6. Cook meats and freeze them in individual portions

These days, I’m a committed watcher of expiry dates. Before any meats go bad, I have a big cook-up and freeze them into individual meal-sized portions of 100 grams each. As a single person, this is a great strategy. Then, when it comes time to eat, you just grab your protein, reheat and dump it on your fat and carb. If you’re particularly budget conscious, I recommend making friends with mince and sausages – or legumes, for the vegetarians.

7. Separate out food costs from household items and eating out

When I track my spending and write my monthly budgets, I only include under my “food” category the cost of actual food I have bought to prepare meals at home. Eating out at restaurants or buying takeaway goes under my “lifestyle” category – as does alcohol.

Loading

Crucially, I also separate out all non-edible grocery purchases – like tissues, shampoo, cleaning products and homewares – and categorise them under “household” expenses. Yes, I literally get each receipt and highlight these non-food items to make sure they are tracked separately.

Getting really clear on how much it costs to feed yourself is a real eye-opener. I have written this PDF worksheet to help get you started.

Of course, individual preferences will always come into play when it comes to food. You do you. But if you’re looking to make savings, your food budget is a great place to start.

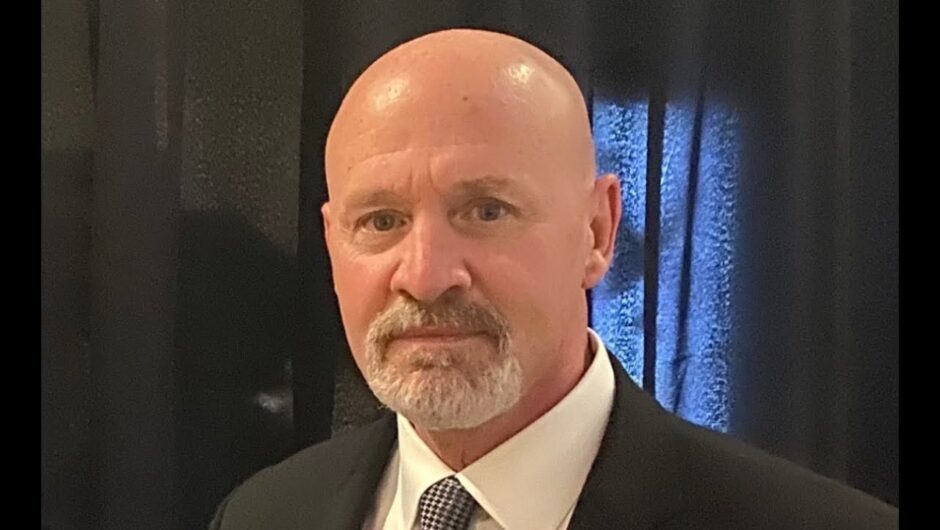

You can follow Jess’ culinary and money adventures on Instagram at @moneywithjess. Subscribe to her weekly email newsletter via The Age at newsletters.theage.com.au/moneywithjess or via the Sun-Herald at newsletters.smh.com.au/moneywithjess

Jessica Irvine is a senior economics writer with The Sydney Morning Herald.

Most Viewed in Money

Loading